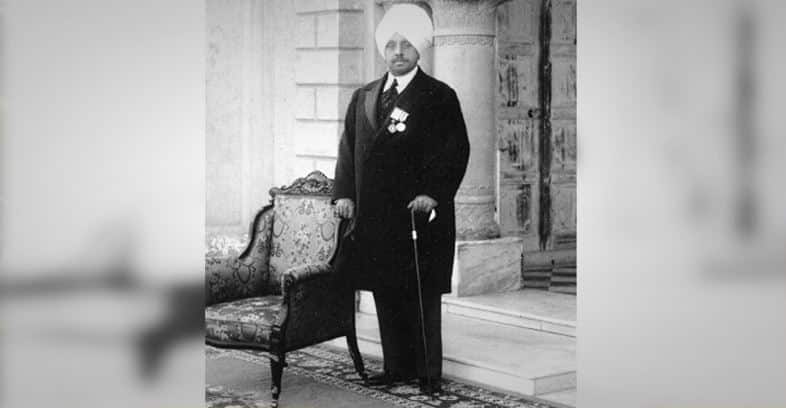

Maharaja Pratap Singh’s reign (1885-1925) in Jammu and Kashmir was a time of significant change, with the land revenue system undergoing a particularly crucial transformation. Inheriting a system rife with corruption and exploitation, Pratap Singh’s era saw the implementation of a landmark settlement that aimed to rationalize revenue collection and alleviate the burdens on the peasantry.

The State of Affairs: A System in Need of Reform

When Pratap Singh took the throne, the land revenue system was in disarray, characterized by several key problems:

- Unjust and Oppressive Taxation: The state levied taxes on virtually everything, leaving the people with little respite. Even essentials like salt were heavily taxed. This oppressive system led to widespread poverty and suffering, particularly among the peasantry who bore the brunt of the tax burden.

- Complex and Defective Revenue Collection: The revenue collection process was inefficient and riddled with loopholes, resulting in significant losses for the state and enabling extortion by revenue officials. The lack of a standardized system for measuring cultivated land further compounded these issues.

- Rampant Corruption and Embezzlement: Corruption was endemic within the revenue administration, with officials routinely siphoning off large portions of the state’s income. This left the state treasury depleted and further exacerbated the plight of the people.

- Exploitative Practices: The practice of auctioning villages to the highest bidders led to a vicious cycle of exploitation. Individuals with no understanding of the local conditions or capacity of the villages would often win these auctions, only to extract as much revenue as possible, further impoverishing the peasantry.

These factors combined created a land revenue system that was both financially unsound and deeply unjust, causing immense hardship for the people of Jammu and Kashmir.

Enter the Reforms: The Wingate-Lawrence Settlement

While Pratap Singh himself did not directly enact specific reforms, his rule coincided with a significant shift in the land revenue system, largely driven by the British influence within the state administration. The most notable change was the introduction of a new revenue settlement initiated by Andrew Wingate and implemented by Walter Lawrence. This settlement introduced several key changes:

- Systematic Land Assessment: Lawrence, as the Settlement Commissioner, meticulously surveyed landholdings, classifying them based on soil type, irrigation facilities, and the types of crops cultivated. This methodical approach aimed to create a more accurate and fair assessment of the land’s productive capacity, moving away from the arbitrary and inconsistent assessments of the past.

- Fixed Revenue Rates: The new settlement shifted from variable rates and in-kind payments to a system of fixed cash revenue rates based on land productivity. This standardization aimed to reduce the scope for manipulation and extortion by revenue officials while also aligning the revenue system with the emerging cash economy.

- Efforts to Curb Corruption: While corruption persisted, the reforms attempted to address the issue through greater transparency and accountability. The introduction of a more structured and standardized system, along with increased oversight, aimed to make it more difficult for officials to engage in corrupt practices.

The Aftermath: Assessing the Impact

The Wingate-Lawrence settlement had a profound impact on the land revenue system in Jammu and Kashmir, leading to several significant outcomes:

- Increase in State Revenue: The implementation of the settlement led to a substantial increase in the state’s annual land revenue. This financial boost provided much-needed resources for the state administration and facilitated further development initiatives.

- Transition to a Cash Economy: The shift from in-kind payments to a cash-based system marked a significant change in the economic landscape of the state. This transition aligned the revenue system with broader economic trends and facilitated greater integration with the market economy.

- Contested Claims of Peasant Prosperity: Some historians view the settlement as a positive step towards improving the lives of cultivators. However, others challenge this narrative, arguing that while the reforms brought some improvements, they did not fundamentally alter the power dynamics within the agrarian system. The persistence of issues like forced labor, indebtedness, and the power of jagirdars (landholders with special privileges) continued to burden the peasantry, raising questions about the extent to which the reforms truly benefited them.

A Lasting Legacy: Pratap Singh’s Place in History

The changes to the land revenue system during Pratap Singh’s reign represent a pivotal chapter in the history of Jammu and Kashmir. While Pratap Singh’s direct role in these reforms remains a subject of debate, his era undoubtedly witnessed a transformation of the land revenue system, laying the foundation for a more modern and structured administration.

It is crucial to acknowledge that the sources primarily focus on the administrative and financial aspects of the land revenue system, offering limited insight into the social and economic realities faced by the cultivators themselves. Further research focusing on the lived experiences of the peasantry during this period is essential to gain a more comprehensive understanding of the settlement’s impact and its long-term consequences for the people of Jammu and Kashmir.